72 Oil Sands in Canada - a great opportunity

09-09-2007

Copyright of Alberta Energy

What is Oil Sands

Oil sands are deposits of bitumen, a heavy black viscous oil that must be rigorously treated to convert it into an upgraded crude oil before it can be used by refineries to produce gasoline and diesel fuels. Until recently, Alberta's bitumen deposits were known as tar sands but are now referred to as oil sands.

Bitumen is best described as a thick, sticky form of crude oil, so heavy and viscous that it will not flow unless heated or diluted with lighter hydrocarbons. At room temperature, it is much like cold molasses.

Oil sands are substantially heavier than other crude oils. Technically speaking, bitumen is a tar-like mixture of petroleum hydrocarbons with a density greater than 960 kilograms per cubic metre; light crude oil, by comparison, has a density as low as 793 kilograms per cubic metre.

Compared to conventional crude oil, bitumen requires some additional upgrading before it can be refined. It also requires dilution with lighter hydrocarbons to make it transportable by pipelines.

Bitumen makes up about 10-12 per cent of the actual oil sands found in Alberta. The remainder is 80-85 per cent mineral matter - including sand and clays - and 4-6 per cent water.

While conventional crude oil flows naturally or is pumped from the ground, oil sands must be mined or recovered in situ - meaning 'in place.' Oil sands recovery processes include extraction and separation systems to remove the bitumen from sand and water.

Alberta's oil sands comprise one of the world's two largest sources of bitumen; the other is in Venezuela.

Oil sands are found in three places in Alberta - the Athabasca, Peace River and Cold Lake regions - and cover a total of nearly 140,200* square kilometres.

Mineable bitumen deposits are located near the surface and can be recovered by open-pit mining techniques. For example, the Syncrude and Suncor oil sands operations near Fort McMurray, Alberta, use the world's largest trucks and shovels to recover bitumen.

About two tonnes of oil sands must be dug up, moved and processed to produce one barrel of oil. Roughly 75 per cent of the bitumen can be recovered from sand; processed sand has to be returned to the pit and the site reclaimed.

In situ recovery is used for bitumen deposits buried too deeply - more than 75 metres - for mining to be practical. Most in situ bitumen and heavy oil production comes from deposits buried more than 400 metres below the surface of the earth.

Cyclicsteam stimulation (CSS) and steam-assisted gravity drainage (SAGD) are in situ recovery methods, which include thermal injection through vertical or horizontal wells, solvent injection and CO2 methods. Canada's largest in situ bitumen recovery project is at Cold Lake, where deposits are heated by steam injection to bring bitumen to the surface, then diluted with condensate for shipping by pipelines.

Other technologies are emerging such as pulse technology and vapour recovery extraction (VAPEX).

How much of the oil sands area is being developed?

Approximately 2800 oil sands lease agreements are currently in place with the province, totalling 43,800 square kilometres. This leaves close to 69 per cent of oil sands areas available for exploration and leasing.

Does oil sands 'mining' affect the environment?

A large part of mining operations involves clearing trees and brush from a site and removing the overburden - the topsoil, muskeg, sand, clay and gravel - that sits atop the oil sands deposit. The topsoil and muskeg are stockpiled so they can be replaced as sections of the mined-out area are reclaimed; the rest of the overburden is used to reconstruct the landscape when mining is completed.

Developers are required to restore oil sands mining sites to at least the equivalent of their previous biological productivity, which means the region as a whole forms an ecosystem landscape at least as healthy and productive as that which existed before development.

Oil sands operations emit carbon dioxide, a greenhouse gas (GHG), which is considered a contributor to climate change. Oil sands developers have been actively working towards reducing CO2 emissions by 45 per cent per barrel by 2010, compared to 1990 levels.

More information about GHGs and climate change is available at www.gov.ab.ca , Alberta Environment's website devoted to the topic.

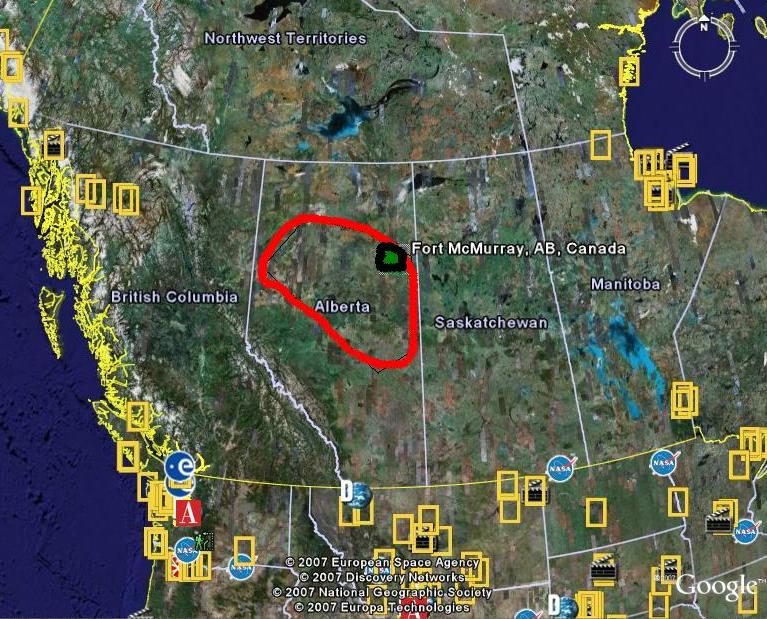

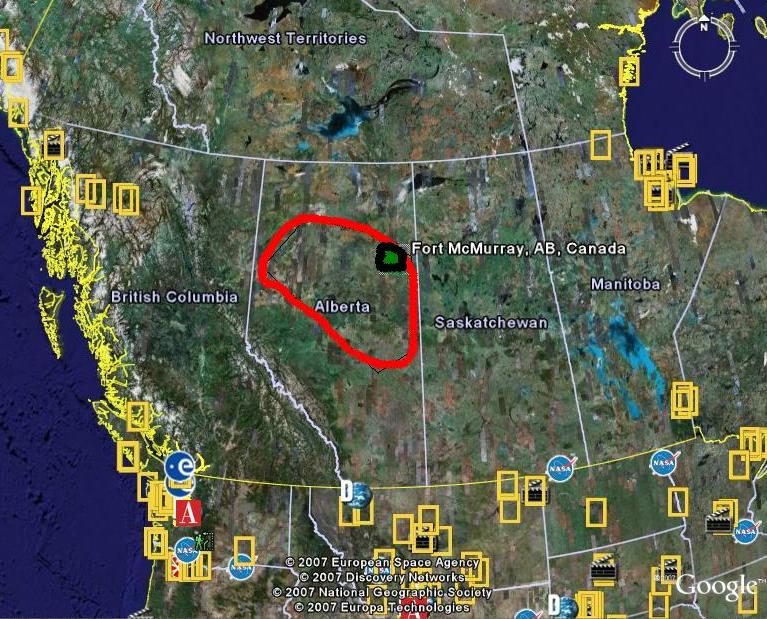

EnergyInisights Map showing main Oil Sands area - in red with Fort McMurray in green

How can I find out about employment in Alberta’s oil sands industry?

There are numerous opportunities in the oil sands industry. You should contact the individual companies with projects in the oil sands or visit their respective web sites for information regarding potential positions.

The Athabasca Regional Infrastructure Working Group (RIWG) web site also posts potential opportunities in the oil sands and northern Alberta at: www.oilsands.cc .

For information on training, apprenticeship and employment in trades in Alberta, you may wish to see the Government of Alberta web site, www.tradesecrets.org .

For potential employment in the Alberta public service, you should see the website of the Personnel Administration Office at: www.pao.gov.ab.ca.

| 2004 Statistics |

| initial volume in place: |

1.6 |

trillion barrels |

| remaining ultimate potential: |

315 |

billion barrels |

| production (marketable): |

973.3 |

thousand barrels per day |

| |

|

|

| royalties: |

$197 |

million ( fiscal 2003-04 ) |

| employment (total oil, gas & oil sands): |

106.8 |

thousand+( direct upstream ) |

| cumulative investment: |

$ 35.2 |

billion ( 1996-2004 CAPP ) |

| investment |

$ 6.2 |

billion ( 2004 CAPP ) |

| |

|

+ Statistics Canada Labour Force Survey

|

|

Canada ranks second largest in terms of global proven crude oil reserves (15% of world reserves), after Saudi Arabia. The majority of these reserves are found in Alberta’s oil sands – over 174 billion barrels.

|

|

Oil sands production of almost 1 million barrels a day (bbls/d) in 2003 now account for approximately 34 per cent of Canada’s total crude output.

|

|

Alberta's oil sands underlie140, 800 square kilometers (54,363 square miles) of primarily northern Alberta; an area larger than the state of Florida.

|

|

It takes about two tonnes of oil sand to produce a barrel of oil.

|

|

Oil sands producers move enough overburden and oil sands every two days to fill Toronto’s Skydome or New York’s Yankee Stadium.

|

|

Alberta’s more than 174 billion barrels of remaining established oil sands is enough oil to fill over 9 million Olympic size swimming pools.

|

Oil prices are set in an open and competitive market and are influenced by many variables throughout North America and the world. These variables include supply and demand, production and exploration levels, global weather patterns, pricing and availability of competing energy sources and market participants’ views of future trends in any of these or other variables.

Crude Bitumen Prices

Supply and Disposition information may be found on the EUB's ST-3 reports; which are available at:

URL: www.eub.gov.ab.ca/BBS/energystats

EUB also provides Oil Prices; which is obtained from selected oil producers that submit statements to the EUB. This information is also provided on the EUB ST-3 reports.

[ crude bitumen is found under the 'oil' section ]

Various prices, factors, and "R" multipliers for oil which are necessary to determine the royalty volume payable to the Crown are published in the department's Information Letters.

The heavy oil royalty factor can be found on the Information Letters named:

"Petroleum Royalty Regulation, A.R. 248/90, as Amended

Prices and Factors"

The last section of these letters provide a table called:

CRUDE OIL ROYALTY CALCULATION DATA TABLE - Heavy

|

The HUTF

Alberta is continually seeking new ways to enhance the viability and value-added upgrading of its energy resources. Alberta Energy is focusing on developing an integrated energy strategy that looks beyond extraction and maximizing the potential of our resources to enhance the growth of Alberta’s refining and petrochemical industries.

The Government of Alberta and industry representatives have developed a vision that expects and enables opportunities for hydrocarbon upgrading and bitumen to play a leading role in Alberta's broader energy strategies. Given the size of the oil sands resource, it has the potential to be a long-term supply of competitively priced refining and petrochemical feedstock.

The HUTF was established in February 2004 to produce an action plan for achieving maximum upgrading of Alberta’s bitumen resources. The task force consists of over 75 representatives from government and industry (including bitumen producers, refiners, and petrochemical stakeholders). The priority objectives and subsequent actions of the HUTF include the following:

- Develop a business case to support an eco-industrial complex for the upgrading of bitumen into transportation fuels and petrochemicals in Alberta.

- Develop an environment that supports the development of technology and processes that will secure a favourable competition position.

- Review best practices and benchmarks for successful jurisdictions that have developed concentrated energy industrial complexes.

- Identify the labour, infrastructure and logistical challenges to development in Alberta.

HUTF - Vision and Mandate

Vision 2020

Alberta to achieve a competitive hydrocarbon upgrading industry through refining and petrochemical plants that expand the markets for Alberta’s bitumen resource and produces higher valued products in Alberta.

Mandate

To develop information, strategies and recommendations for attaining the vision:

- Describe the prize (e.g. benefits for both Albertans and industry).

- Build the market-based business case for upgrading hydrocarbon resources in Alberta.

- Identify opportunities and challenges.

- Conduct additional studies such as market effects, capital cost and downstream integration.

- Develop and evaluate strategies for industrial integration, market penetration and technology development.

- Provide advice to government on how to achieve the vision.

The HUTF vision of what success looks like by 2020

- World-scale integrated industrial complexes that upgrade bitumen to produce competitively priced, higher value products such as synthetic crude oil, base and specialty chemicals and other refined products.

- Bitumen production reaches three million barrels per day with a significant portion upgraded in Alberta.

- Flexible manufacturing and transportation infrastructure provides broad access to various markets.

- Albertans benefit from increased resource royalties, a higher tax base, a well-paid and skilled workforce and an increased proportion of higher value product exports.

Action Plan

In order to successfully achieve the vision and mandate for the HUTF, an action plan has been established. The action plan includes the following three main initiatives:

- Develop the general business case for upgrading hydrocarbon resources to higher value products in Alberta:

- Complete market analysis studies that include an investigation of market logistics, refined products and chemicals market.

- Additional studies may be required to provide further information and insight, such as, capital cost benchmarks, technology development, market access, downstream integration studies (industrial and consumer products) and infrastructure requirements.

- Identify opportunities, barriers and options.

- Confirm economic advantages/disadvantages to upgrading bitumen in Alberta versus other locations based on delivered cost to market approach, including capital depreciation.

- Conduct detailed analysis of economic benefits of upgrading to Albertans.

- Communicate and market the opportunities:

- Develop strategies to publicize and promote the business case(s) that highlight Alberta’s opportunities and advantages for upgrading and market access for refined products, petrochemicals and fence line industries. The target audiences are local and international investment communities and governments.

- Continue to work with industry to build consensus as to information, facts interpretations and attractiveness.

- Develop strategies to communicate the short-term and long-term benefits of hydrocarbon-based manufacturing in Alberta to the public.

- Provide advice to government:

- Communicate short-term and long-term benefits of hydrocarbon-based manufacturing to senior bureaucrats and elected representatives.

|

|

Industry and government are jointly pursuing studies on the technical and market opportunities for new refining and petrochemical feedstock potential. In 2002, an industry/government study explored opportunities for alternative feedstocks, including oil sands upgrading and co-products of refineries and existing ethane crackers. To date, these studies have shown that returns from increased upgrading and refining are potentially attractive and that export markets may exist for refined product from Alberta.

In 2004, an industry/government Task Force (the HUTF) was established to explore synergies of other competitive opportunities with the refining and petrochemical industries. Two studies have recently been initiated:

- Integration - assess the product integration opportunities for feedstocks, petrochemicals, fertilizers, syngas and electricity with bitumen upgrading and refining in Alberta.

- Best Practices - review successful integrated hydrocarbon clusters in various jurisdictions around the world to identify competitive gaps for Alberta.

Value-added upgrading of energy resources in Alberta is a high priority. The HUTF is supporting this priority by developing the business case for adding value to bitumen for new refining capacity and as a source of petrochemical feedstock.

HUTF presentations and studies:

- Petrochemicals from Oil Sands - T.J. McCann and Associates (July 2002)

- Phase I Summary - Bitumen to Refined Products and Petrochemicals - Purvin & Gertz Inc., (April 28, 2004)

- Phase II Report - Refined Products and Petrochemicals from Bitumen - Purvin & Gertz Inc., CMAI Inc. (Dec. 17, 2004)

- Oil Sands Products Analysis for Asian Markets - Purvin & Gertz Inc. (April 15, 2005)

- Alberta Bitumen Processing Integration Study – David Netzer and Associates (March 2006)

- Hydrocarbon Upgrading Task Force - March 5, 2007

- Hydrocarbon Upgrading Demonstration Program (HUDP)-Update

- Action Plan Update

- Incremental Ethane Extraction Policy (IEEP)

- Labour Update

- The Making of Three Energy Complexes-Integration at Work

- Oil Sands Consultations Update

- Hydrocarbon Upgrading Task Force - June 20, 2007

- Hydrocarbon Upgrading Demonstration Program (HUDP)-Update

- Action Plan Update

- Study of Environmental Benefits of Industrial Integration

- IEEJ Asia Market Study for Oil Sands and Products

- Impact of Oil Sands Royalty Regime on Capital Efficiency

- Gasification Chair at University of Saskatchewan

- PTAC-Upgrading, Refining, Petrochemical and Hydrogen Technologies

- Capital Region Integrated Infrastructure Planning

Other Links:

- Alberta Economic Development - Chemical & Petrochemicals Website

|

|

Alberta’s petrochemical industry is based on adding valued to natural gas liquids (NGL) feedstocks, mainly ethane with some manufacturing based on propane and butane. While Alberta is currently Canada’s largest petrochemical producing area and one of the most competitive in North America, it is important to continue to seek improvement and innovation to maintain its competitive advantages. Alberta Energy recognizes that innovation is a key to maintaining long-term success and is actively working with industry to explore alternatives to natural gas use in oil sands operations. For example, gasification of bitumen or the production of refinery fuel gas from upgrading and refining operations could become a significant source of fuel and hydrogen for the oil sands industry, freeing up new feedstock supplies for the petrochemical industry.

The oil sands operations present many new opportunities for the petrochemical industry, including :

- Integration of petrochemical plants with refineries that convert bitumen to refined petroleum products.

- Gasification of oil sands by-products (e.g. create syngas from petroleum coke).

- Use of off-gases from the distillation and upgrading of bitumen as feedstock.

Given the size of the oil sands resource, it has the potential to be a long-term supply of competitively priced petrochemical feedstock. Some possible products from these processes could include: ethylene, propylene, benzene, polyethylene, naphtha, diesel, gasoline. The HUTF studies include identification of these bitumen-based opportunities. | |

Alberta Energy

Printer Friendly version...