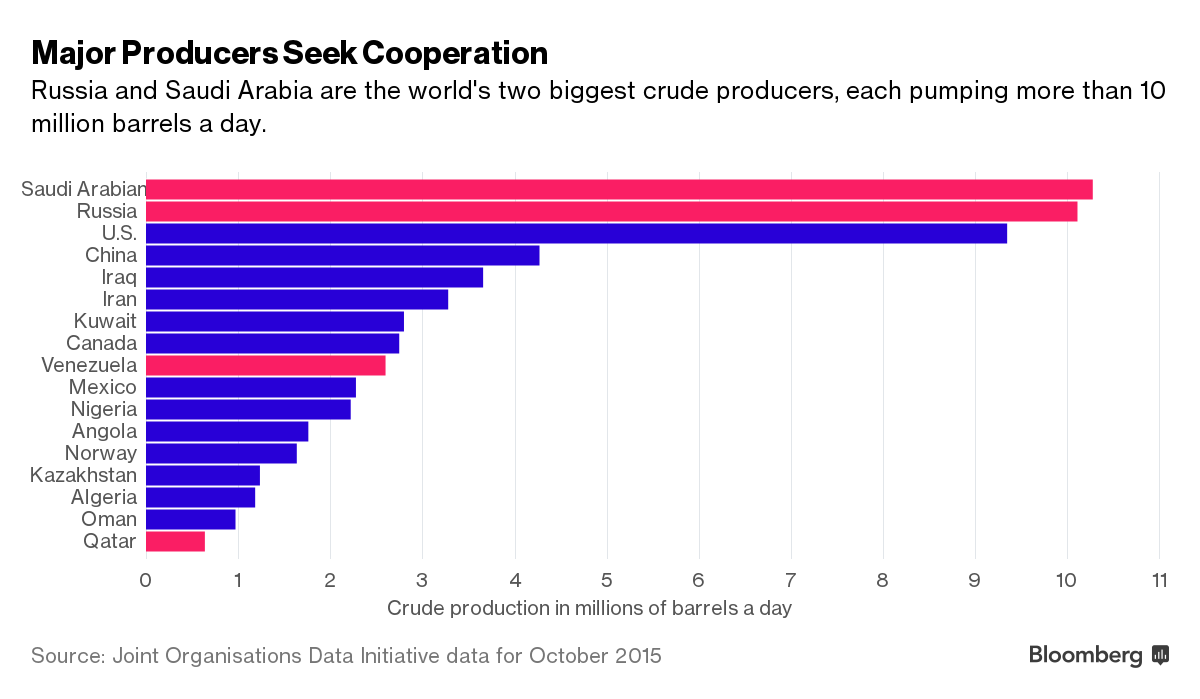

Saudi Arabia and Russia agreed to freeze oil output at near-record levels, the first coordinated move by the world’s two largest producers to counter a slump that has pummeled economies, markets and companies.

While the deal is preliminary and doesn’t include Iran, it’s the first significant cooperation between OPEC and non-OPEC producers in 15 years and Saudi Arabia said it’s open to further action. Oil pared gains after the accord was announced, signaling traders see no immediate end to the global supply glut.

The deal to fix production at January levels, which includes Qatar and Venezuela, is the “beginning of a process” that could require “other steps to stabilize and improve the market,” Saudi Oil Minister Ali Al-Naimi said in Doha Tuesday after the talks with Russian Energy Minster Alexander Novak. Qatar and Venezuela also agreed to participate, he said.

Saudi Arabia has resisted making any cuts in output to boost prices from a 12-year low, arguing that it would simply be losing market share unless its rivals also agreed to reduce supplies. Naimi’s comments may continue to feed speculation that the world’s biggest oil producers will take action to revive prices.

“The reason we agreed to a potential freeze of production is simply the beginning of a process” over next few months,” Naimi told reporters. “We don’t want significant gyrations in prices. We don’t want a reduction in supply. We want to meet demand. We want a stable oil price.”

Prices Fall

More than a year since the Organization of Petroleum Exporting Countries decided not to cut production to boost prices, oil remains about 70 percent below its 2014 peak. Supply still exceeds demand and record global oil stockpiles continue to swell, potentially pushing prices below $20 a barrel before the rout is over, Goldman Sachs Group Inc. said last week.

While Novak has said he could consider cuts if other countries joined in, Russia faces significant obstacles to doing so. The freeze is conditional on other nations agreeing to participate, Russia’s Energy Ministry said in a statement.

“This is an announcement of a production freeze among countries whose production didn’t even grow recently,” said Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt. “If Iran and Iraq are not a part of the agreement, it’s not worth much -- and even then there is still a question of compliance.”

Oil erased gains in London after rising before the meeting amid speculation the countries would discuss production cuts. Brent crude fell 0.2 percent to $33.30 a barrel at 1:52 p.m. in London, having earlier climbed as much as 6.5 percent.

Production Gains

Iran, OPEC’s fifth-largest producer, ruled out any curbs on its oil production when the group met in December. It plans to boost output and exports by 1 million barrels a day this year following the lifting of international sanctions last month. This week the nation loaded its first Europe-bound crude cargo in four years.

“Iran will not forgo its share of the market,” the Oil Ministry’s news service Shana reported Tuesday, citing Minister Bijan Namdar Zanganeh.

Iraq continues to boost production as it recovers from years of conflict and under investment. The nation’s output reached a record 4.35 million barrels a day in January and more increases could follow, according to the International Energy Agency. The country is prepared to cap production at current levels, or even cut, if other producers commit to the Doha accord, said an official from who asked not to be identified because oil policy is private.

Iran Concession

There is a precedent for some countries being excused from full compliance with a freeze in order to secure their backing. In 1999, when OPEC came together with other producers including Mexico to fight an oil price slump, Saudi Arabia agreed to let Iran fix output at a higher level than in the past.

The freeze deal comes after months of competition for market share between Russia and Saudi Arabia. Riyadh has taken the rare step of selling crude into Moscow’s backyard of eastern European, while Russia overtook Saudi Arabia in oil exports into China. The two nations are also backing opposite sides in the Syrian civil war.

According the IEA, Saudi Arabia produced 10.2 million barrels a day in January, below the most recent peak of 10.5 million barrels a day set in June 2015. Russia produced nearly 10.9 million barrels a day in the same month, a post-Soviet record, according to official data. Venezuela pumped 2.4 million barrels a day and Qatar produced 680,000, according to the IEA.

Qatar will lead monitoring of the output freeze agreement, the nation’s Energy Minister Mohammad bin Saleh al-Sada said at a press briefing. Low oil prices haven’t been positive for the world, he said.

"A freeze would not create an immediate U-turn, but it creates a better foundation for the price recovery in the second half," Olivier Jakob, managing director of consultant Petromatrix GmBh, said in a note to clients.