Summary of oil production scenarios and their effect on CO2 emissions

To estimate the differences in CO2 emissions associated with conventional and unconventional oil, we prepared six different scenarios, based on three future forecasts of conventional oil production and two of development of unconventional oil resources. By combining the two, this gives six scenarios in all.The differences in the conventional oil production scenarios are due mainly to two factors: the interpretation of current reserve figure and the extent to which technological developments are expected to boost recoverable reserves from existing fields. This leads to the following three scenarios for the production of conventional oil:

1) In the Technology scenario, the worldwide decline in production from existing fields is assumed to stabilise within 15 years at 2.5% per year instead of the current 4.5% per year. The estimate of 4.5% is derived from a number of studies by Goldman Sachs, Cambridge Energy Research Associates and the International Energy Agency. The depletion rate of 2.5% per year means that 908 billion barrels can be produced from existing fields. The current production base will decrease from 81.8 million barrels per day to 38.2 million barrels per day in 2030. This declining production from existing fields will be augmented by new production from oil fields presently under development with a total reserve of 206 billion barrels. In this scenario current reserves (proven + probable) thus total 1,114 billion barrels. For yet to be found discoveries, an amount of 181 billion barrels is assumed, implying a total of 1,317 billion barrels of conventional oil yet to be produced. Production of conventional oil in this scenario will peak around 2016 at a level of 92 million barrels per day. In 2030 production will have declined to a level of 62 million barrels per day.

2) In the Business as usual scenario, the current rate of depletion of existing fields is assumed to remain at 4.5% per year. This means 632 billion barrels will be produced from current reserves and the current production base will decrease from 81.8 million barrels per day in 2006 to 27.1 million barrels per day in 2030. In addition to this declining production base for existing fuels, new production will come on stream from reserves currently under development, adding 206 billion barrels of new reserves. Current reserves (proven + probable) in this scenario are thus 838 billion barrels. This scenario also assumes discovery of 181 billion barrels of oil, increasing total recoverable reserves of conventional oil to 1,021 billion barrels. Production of conventional oil in this scenario will peak around 2015 at a production level of 89 million barrels per day. In 2030 production will have declined to 51 million barrels per day.

3) In the Rapid depletion scenario it is assumed that the current depletion rate of 4.5% per year will accelerate as OPEC reserves are less than previously thought. From current reserves 462 billion barrels of oil will be produced. The current production base will decrease from 81.8 million barrels per day in 2006 to 18.2 million barrels per day in 2030. In addition to this, production amounting to 206 billion barrels of oil from fields currently under development will come on stream. In this scenario current reserves (proven + probable) thus total 668 billion barrels. It is also assumed that 181 billion barrels are yet to be discovered, increasing total recoverable reserved to 860 billion barrels in this scenario. Production of conventional oil will then peak around 2010 at about 87 million barrels per day. In 2030 this will have decreased to 42 million barrels per day.

In addition to these scenarios for conventional oil, two scenarios for unconventional oil were added: Steady growth and Accelerated growth.

a) In Steady growth, the production growth in unconventional oil witnessed in recent years is assumed to continue. Production of tar sands, extra heavy oil, coal-to-liquids and gas-to-liquids is thus taken to increase from the current figure of 2.42 million barrels per day to 5.3 million in 2020 and 10.5 million in 2030. This scenario is based on current trends and industry plans. It assumes there will be no development of oil shale in the US because of environmental concerns and technological barriers. In addition, very little increase in production of coal-to-liquids is assumed relative to the potential available in the world’s major coal reserves, because of environmental concerns and the likelihood of large additional CO2 emissions

b) In the Accelerated growth scenario, production of unconventional oil rises to 11 million barrels per day in 2020 and 22 million barrels per day in 2030. In this scenario it is assumed that less attention is given to environmental concerns, because the need for access to liquid fuels is assumed to overrule these concerns. This means CTL production will be 3 times as large in 2030 as in the Steady growth scenario. Commercial oil shale production is also assumed to increase, reaching an output of 2 million barrels in 2030. Production of extra heavy oil will also grow more than in the Steady growth scenario.

Combining the three scenarios for conventional oil and two for unconventional oil yields the following peak production values:

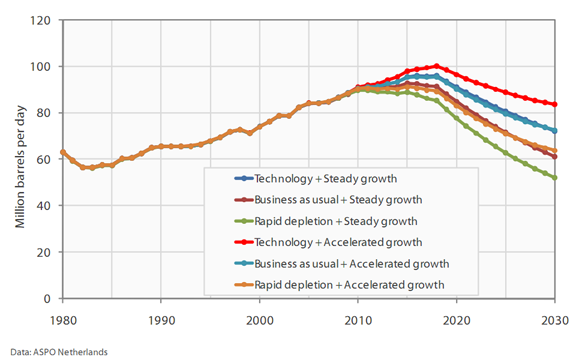

Figure 1 - Combined conventional and unconventional oil production scenarios to 2030, Source: ASPO Netherlands.

Figure 1 - Combined conventional and unconventional oil production scenarios to 2030, Source: ASPO Netherlands.

1a) Technology + Steady growth: peak production in 2012 at a level of 96 million barrels

per day and a production decline of 2% to 3% per year to 72 million barrels per day in 2030.

2a) Business as usual + Steady growth: peak production in 2015 at a level of 90 million barrels

per day and a rapid production decline of 3% to 4% per year to 61 million barrels per day in 2030.

3a) Rapid depletion + Steady growth: peak production in 2010 at a level of 101 million barrels

per day and a rapid production decline of 4% to 5.5 % per year to 52 million barrels per day in 2030.

1b) Technology + Accelerated growth: peak production in 2018 at a level of 101 million barrels

per day and a slow production decline of 1% to 2% per year to 84 million barrels per day in 2030.

2b) Business as usual + Accelerated growth: peak production in 2018 at a level of 96 million barrels

per day and a normal production decline of 2% to 3% per year to 73 million barrels per day in 2030.

3b) Rapid decline + Accelerated growth: peak production in 2015 at a level of 92 million barrels

per day and a rapid production decline of 3% to 4% per year to 64 million barrels per day in 2030.

The scenarios show that despite the rapid development of unconventional oil, total oil production will still reach its peak during the coming decade. This is because there will not be enough new production capacity from either conventional or unconventional oil to compensate the depletion of current oil fields. The 208 billion barrels of reserves in fields which the industry is planning to develop during the next 10 years are not sufficient to compensate for the depletion of existing fields. Nor are the projected 181 billion barrels of newly discovered oil, which should lead to 16 million barrels per day in new production around 2020, sufficient. Even a lower depletion rate than the current average of 4.5% per year in fields that have not yet peaked will hardly postpone the peak, though the production level at which the peak is reached will be much higher.

Because of continuing depletion of conventional oil resources and the relatively slow rate at which unconventional oil can fill the gap by increased production, the production peak in world oil production will occur some time during the coming decade. The decline in production will be dampened by a marked increase in unconventional oil production, however. In the combinations of the conventional production scenarios and the Accelerated growth scenario for unconventional oil, production declines more slowly than in the combination with the Steady growth scenario.

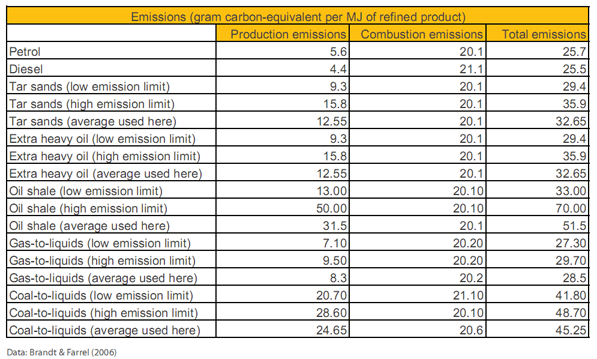

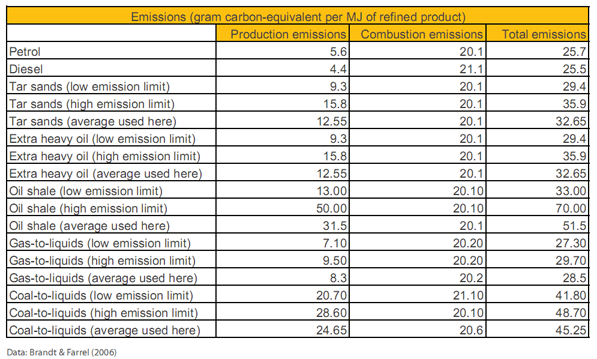

The impact of the various scenarios on CO2 emissions was calculated using the carbon emission factors reported in table 1 below.

Table 1 - Carbon emission factors for the production and combustion of various types of liquids, Source: Farrel & Brandt (Paper link), (Excel file).

Table 1 - Carbon emission factors for the production and combustion of various types of liquids, Source: Farrel & Brandt (Paper link), (Excel file).

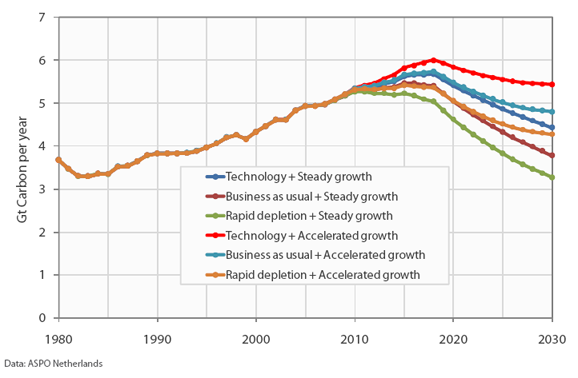

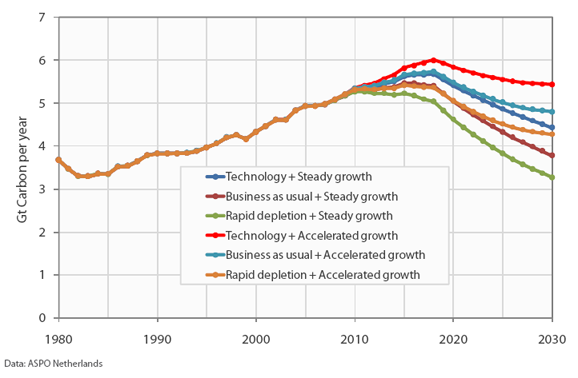

In the Rapid depletion + Steady growth scenario, emissions peak in 2010 at a level of 5.4 gigatonnes of carbon, decreasing to 3.3 gigatonnes around 2030. In the Technology + Accelerated growth scenario, in contrast, emissions peak in 2018 at a level of 6 gigatonnes of carbon, decreasing slightly to 5.4 gigatonnes in 2030. The difference in cumulative carbon emissions between these two extreme scenarios will amount to 25 gigatonnes less CO2 in the period 2007 to 2030.

Figure 2 - Emissions resulting from the conventional and unconventional oil production scenarios to 2030 in gigatonnes of carbon, Source: ASPO Netherlands.

Figure 2 - Emissions resulting from the conventional and unconventional oil production scenarios to 2030 in gigatonnes of carbon, Source: ASPO Netherlands.

Considering these data, an energy path that is increasingly reliant on unconventional oil is not a desirable one if one assumes that climate change is mainly driven by CO2 emissions from fossil fuels. This because there will be no decline in CO2 emissions in an Accelerated growth scenario versus current CO2 emission levels. Even in the Rapid depletion + Accelerated growth scenario, CO2 emissions from oil usage will be similar in 2030 to emissions in 2004, despite a decline in total world oil production from 84 million barrels per day now to 64 million in 2030. This kind of growth in unconventional oil seems inevitable, though, unless robust policies are implemented to substitute other energy sources for oil and for transportation fuels and, in the longer term, for chemical feedstocks, too. As conventional oil becomes scarcer and oil prices rise ever further, there will be growing pressure to produce these unconventional types of oil. It is therefore important that governments plan for a production peak and encourage alternatives that can offset the depletion of conventional oil in time.

Overall Report Conclusions

As more data become available, it is becoming increasingly clear that conventional oil production will peak some time during the coming decade. Peak production will impact significantly on CO2 emissions. Geological and technological barriers as well as constraints relating to the water and energy requirements of unconventional oil production will mean these other types of oil cannot take over conventional oil’s key role in the coming decades. All the scenarios we ran for the purpose of this study, including the Accelerated growth scenario in which unconventional oil production rises to 22 million barrels per day in 2030, point to a peak in oil production during the next decade.

One might expect that the peak in oil production would cause CO2 emissions from oil to decline, but the scenarios analysed in this report suggest this is not likely to be the case, even though total oil production is expected to be much lower.

In the most favourable case this development of unconventional oil after the peak will lead to oil-related CO2 emissions declining only slightly and possibly even increasing somewhat. This is because the production of unconventional oil and refining it to a high-grade end product are associated with far higher CO2 emissions than in the case of conventional oil. Measured over the entire cycle from production to combustion, coal-to-liquids, oil shales and extra heavy oil score worst in this respect. In numerical terms the scenarios produce the following results: In 2007 production of unconventional oil was 2.4 million barrels per day. With steady growth of unconventional oil to 11 million barrels per day in 2030 and a peak in conventional oil between 2010 and 2017, CO2 emissions will decrease from 4.9 gigatonnes in 2006 to between 3.3 and 4.4 gigatonnes in 2030. The latter range depends on the exact timing and the steepness of the decline in conventional oil production. With accelerated growth of unconventional oil production to 22 million barrels per day in 2030, combined with the same production decline in conventional oil, CO2 emissions will hardly decline and will total 4.3 to 5.4 gigatonnes in 2030.

The energy path to unconventional oil is thus undesirable, as there will be no decline in CO2 emissions if there is vigorous growth of unconventional oil. Unless there is large-scale substitution of oil by other energy sources and energy carriers for transport and, in the longer term, for petrochemicals, such growth will be inevitable, however. As less and less conventional oil appears on the market, pressure to produce unconventional oil will grow. This will raise the price of a barrel of oil, making unconventional oil production ever more attractive in commercial terms. Governments have a major role to play in facilitating the transition away from unconventional oil, as present-day market structures are inherently skewed towards the use of oil, whether conventional or unconventional.

Governments that fail to plan for the decline in global oil production problem will be confronted with a major dilemma. On one hand, they can abandon climate policy to reduce CO2 emissions, so more oil can be made available to limit economic and social problems. Alternatively, such policy can be maintained, or even invigorated, with CO2 limits being applied to conventional and unconventional oil, leading to less oil becoming available on the market. It is therefore essential that governments anticipate the peak in conventional oil production. Alternatives need to be encouraged to compensate for production declines in conventional oil in both a timely and adequate manner.

The dynamics of this dilemma are not reflected in the IPCC scenarios, which make no fundamental distinction between readily exploitable conventional oil and harder to recover unconventional oil. IPCC production modelling assumes that decreases in the quality and energy content of reserves over time will not affect production. Technological barriers as well as external constraints on water and energy availability are not taken into account, even though these impose real limits on production. Actual CO2 emissions from oil production will therefore differ significantly from the projections of these scenarios. We also consider the underlying data in the production models, including those for coal, too optimistic. This is because these data assume a continuous productivity rise of 1% per year until 2100, with the whole of this productivity rise being allocated to the model’s starting point. In other words, the model implicitly assumes a 100% productivity rise in 2000, after which productivity remains constant. Apart from the fact that this immediate rise of 100% is unrealistic, it is also doubtful whether the historical productivity data on which this figure of 1% per year is based is a good model of the future, as the concentration and quality of reserves will decrease significantly over time. This will mean rising energy inputs for the same output, pushing costs up and implying that productivity improvements will not be realised.

europe.theoildrum.com